Background

The Immigration Reform and Control Act (IRCA), enacted on November 6, 1986, requires employers to verify the identity and employment eligibility of their employees and sets forth criminal and civil sanctions for employment-related violations. Section 274A(b) of the Immigration and Nationality Act (INA), codified in 8 U.S.C. § 1324a(b), requires employers to verify the identity and employment eligibility of all individuals hired in the United States after November 6, 1986. 8 C.F.R. § 274a.2 designates the Employment Eligibility Verification form (Form I-9), as the vehicle for documenting this verification. For current employees, employers are required to maintain for inspection original Form(s) I-9 on paper or as an on-screen version generated by an electronic system that can produce legible and readable paper copies. For former employees, the retention of Form(s) I-9 is required for a period of at least three years from the first day of employment or one year from the date employment ends, whichever is longer.

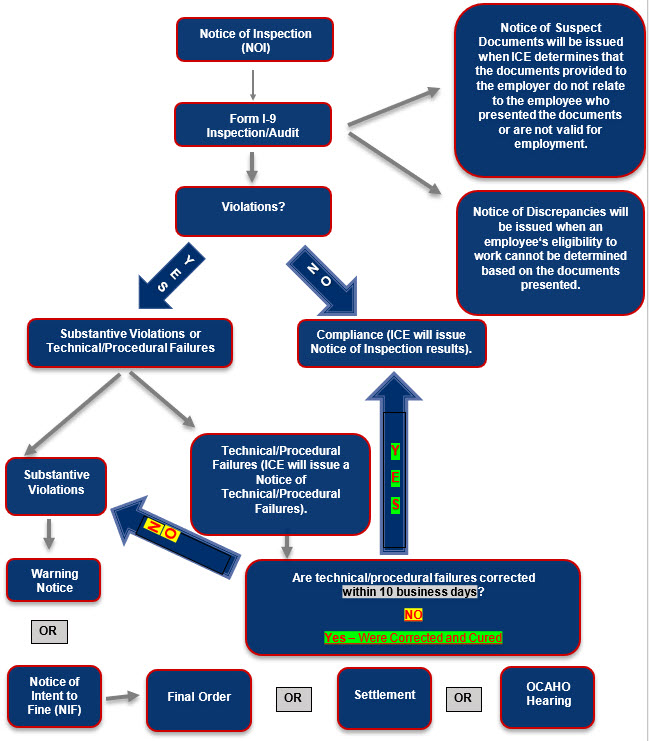

Inspection Process

The administrative inspection process is initiated with the service of a Notice of Inspection (NOI) upon an employer. Pursuant to 8 C.F.R § 274a.2(b)(2)(ii), employers receive at least three business days to produce the Form(s) I-9 requested in the NOI. In addition, HSI generally requests that the employer provide supporting documentation, which may include, but is not limited to, a copy of the employer’s payroll, a list of active and terminated employees, articles of incorporation, and business licenses.

When an employer responds to a NOI by producing Form(s) I-9, HSI agents and/or auditors conduct an inspection of the Form(s) I-9 for compliance. When HSI finds technical or procedural failures, the employer receives at least 10 business days to make corrections, pursuant to INA §274A(b)(6)(B) (8 U.S.C. § 1324a(b)(6)(B)). An employer may receive a monetary fine for all substantive violations and uncorrected technical or procedural failures.

Outcomes

Employers who are found to have knowingly hired or continued to employ unauthorized workers under INA § 274A(a)(1)(a) or (a)(2) (8 U.S.C. § 1324a(a)(1)(a) or (a)(2)) will be required to cease the unlawful activity and may be civilly fined and/or criminally prosecuted. Additionally, an employer who is found to have knowingly hired or continued to employ unauthorized workers may be subject to debarment by HSI under 48 C.F.R. § 9.406-2(b)(2).

Upon completing its inspection of an employer’s Form(s) I-9 and any related supporting documentation, HSI will notify the employer of its findings in writing by issuing one of the following notices:

- Notice of Inspection Results: Also known as a "Compliance Letter," this notice is used to notify a business that it is in compliance with applicable employee eligibility verification requirements.

- Notice of Suspect Documents: Advises the employer that, based on a review of the Form(s) I-9 and documentation submitted by relevant employee(s), HSI has determined that the documentation presented by employee(s) do not relate to the employee(s) or are otherwise not valid for employment. This notice also advises the employer of the possible criminal and civil penalties for continuing to employ unauthorized workers. HSI provides the employer and employee(s) an opportunity to provide documentation demonstrating valid U.S. work authorization if they believe the finding is in error.

- Notice of Discrepancies: Advises the employer that, based on a review of the Form(s) I-9 and any related documentation submitted by employee(s), HSI has been unable to determine the employees’ eligibility to work in the U.S. The employer should provide the employee(s) with a copy of the notice, as well as an opportunity to present HSI with additional documentation establishing valid U.S. employment eligibility.

- Notice of Technical or Procedural Failures: Identifies technical or procedural failures found during the inspection of Form(s) I-9 and gives the employer at least ten business days to correct the forms. After this correction period ends, uncorrected technical or procedural failures become substantive violations.

- Warning Notice: Issued when substantive verification violations were identified, but there is an expectation of future compliance by the employer. However, a Warning Notice should not be issued in the following circumstances: instances where: (1) the employer was previously the subject of a Warning Notice or a Notice of Intent to Fine; (2) the employer was notified of technical or procedural failures and failed to correct them within the allotted 10-business day period; (3) the employer had a 100% failure to prepare and present Form(s) I-9; (4) the employer hired unauthorized workers as a result of substantive violations; or, (5) there is any evidence of fraud in the completion of Form I-9 (e.g., backdating) on the part of the employer. Companies that are served a Warning Notice may be subject to a follow-up NOI six months, or later, after a Warning Notice is issued to ensure compliance. A reinspection may be contingent on resources.

- Notice of Intent to Fine (NIF): May be issued for substantive violations, uncorrected technical or procedural failures, knowingly hire violations, and/or continuing to employ violations.

In instances where a NIF is served, charging documents specifying the alleged violations committed by the employer will be provided. Pursuant to 5 U.S.C. §§ 554-557, the employer is entitled to a hearing before an Administrative Law Judge at the Office of the Chief Administrative Hearing Officer (OCAHO). This request must be made within 30 calendar days of receipt of the NIF.

If a written request for a hearing is not timely received, ICE will issue a Final Order. There is no appeal from a Final Order. If a written request for a hearing is timely received, the employer may request to engage in settlement negotiations with ICE regarding the charges or fine(s) imposed prior to a hearing before OCAHO. If the employer and ICE reach an agreement, ICE will not file a complaint with OCAHO. However, if the employer and ICE do not reach an agreement, ICE will file a complaint with OCAHO. View additional information about OCAHO.

Determination of Civil Penalty Fine Amounts

The Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015 (Inflation Adjustment Act) adjusts the statutory minimum and maximum civil penalty fine amounts for knowingly hire/continuing to employ violations and substantive violations/uncorrected technical or procedural failures. These amounts are subject to annual adjustment. Please check the current Federal Register for the most updated minimum and maximum civil penalty fine amounts.

Since the passage of IRCA in 1986, federal civil monetary penalties have been increased pursuant to the Federal Civil Penalties Inflation Act of 1990, as amended by the Debt Collection Improvement Act of 1996. In addition, the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015 (the 2015 Act) (Pub. L. No. 114-74, Sec. 701), which further amended the Federal Civil Penalties Inflation Adjustment Act of 1990 (the Inflation Adjustment Act) (Pub. L. No. 101-410, codified as amended at 28 U.S.C. § 2461 note) was enacted on November 2, 2015.On an annual basis, the 2015 Act requires agencies to adjust the level of civil monetary penalties for inflation.

These adjustments are designed to account for inflation in the calculation of civil monetary penalties and are determined by a non-discretionary, statutory formula. See the Federal Register.

When you get to the federal register website type the type “adjust for inflation DHS civil monetary penalties” in the search bar.

The date when ICE serves the NIF on the employer is the fine assessment date that determines the civil penalty range that ICE administers.

To determine the base fine amount, the number of substantive violations/uncorrected technical or procedural failures and knowingly hire/continue to employ violations will be divided by the number of Forms I-9 that should have been presented for inspection. The percentage from this calculation is the violation percentage that will determine the minimum and maximum civil penalty base fine amount. This percentage may change depending on whether the offense being evaluated is the employer’s first offense, second offense, or a third or higher offense.

Once the base fine amount is determined, the five statutory factors (size of the business, good faith of the employer, seriousness of the violation(s), involvement of unauthorized worker(s), and history of previous violation(s)) will be given consideration by ICE to determine the total civil penalty fine amount for the substantive violations/uncorrected technical or procedural failures the employer will be charged with. See 8 U.S.C. § 1324a(e)(5) and 8 C.F.R. § 274a.10 (please check the current Federal Register for the most updated minimum and maximum civil penalty fine amounts).

The following matrix will be used to enhance, mitigate, or deem neutral the base fine amount.

| Factor | Aggravating | Mitigating | Neutral |

|---|---|---|---|

| Business size | + 5% | - 5% | +/- 0% |

| Good faith | + 5% | - 5% | +/- 0% |

| Seriousness | + 5% | - 5% | +/- 0% |

| Unauthorized Worker(s) | + 5% | - 5% | +/- 0% |

| History | + 5% | - 5% | +/- 0% |

| Cumulative Adjustment | + 25% | - 25% | +/- 0% |

Other Relevant Notice of Intent to Fine (NIFs) that may be issued by ICE

INA § 274C (8 U.S.C. § 1324c) – Penalties for Document Fraud

Section 274C of the INA authorizes HSI to impose a civil monetary penalty for the possession, use, or attempted use of a fraudulent document to gain a benefit or fulfill a requirement under the INA. This section outlines civil penalties and fines that may be assessed when individuals or entities engage in document fraud to obtain immigration benefits. For unauthorized workers who receive a Final Order under this section, the consequences may include removal from the United States and a permanent bar to reentry. Moreover, individuals or entities who violate this section may be subject to a cease and desist order and a civil monetary penalty. Accordingly, an alien receiving a Final Order under INA § 274C may be inadmissible or removable from the United States.

Activities Covered under INA § 274C

It is unlawful for any person or entity knowingly—

(1) to forge, counterfeit, alter, or falsely make any document for the purpose of satisfying a requirement of this Act or to obtain a benefit under this Act,

(2) to use, attempt to use, possess, obtain, accept, or receive or to provide any forged, counterfeit, altered, or falsely made document in order to satisfy any requirement of this Act or to obtain a benefit under this Act,

(3) to use or attempt to use or to provide or attempt to provide any document lawfully issued to or with respect to a person other than the possessor (including a deceased individual) for the purpose of satisfying a requirement of this Act or obtaining a benefit under this Act,

(4) to accept or receive or to provide any document lawfully issued to or with respect to a person other than the possessor (including a deceased individual) for the purpose of complying with §274A(b) or obtaining a benefit under this Act, or

(5) to prepare, file, or assist another in preparing or filing, any application for benefits under this Act, or any document required under this Act, or any document submitted in connection with such application or document, with knowledge or in reckless disregard of the fact that such application or document was falsely made or, in whole or in part, does not relate to the person on whose behalf it was or is being submitted, or

(6) (A) to present before boarding a common carrier for the purpose of coming to the United States a document which relates to the alien's eligibility to enter the United States, and (B) to fail to present such document to an immigration officer upon arrival at a United States port of entry.

INA § 274D (8 U.S.C. § 1324d) – Civil Penalties for Failure to Depart

Section 274D of the INA authorizes ICE to impose a civil monetary penalty to any alien subject to a final order of removal who willfully fails or refuses to depart from the United States pursuant to the order, make timely application in good faith for travel or other documents necessary for departure, or present for removal at the time and place required by the Attorney General; or conspires to or takes any action designed to prevent or hamper the alien’s departure pursuant to the order, shall pay a civil penalty of not more than $500 to the Commissioner for each day the alien is in violation of this section .

Nothing in this section shall be construed to diminish or qualify any penalties to which an alien may be subject for activities proscribed by section 243(a) of this Act (8 U.S.C 1253(a)) or any other section of this Act.

ICE NIF Process for INA §§ 274(C) and 274(D) Violations

- ICE issues and serves a NIF.

- The recipient can request a hearing before an Administrative Law Judge at the Office of the Chief Administrative Hearing Officer (OCAHO) within 30 calendar days of receipt of the NIF.

- If a written request for a hearing is not timely received, ICE will issue a Final Order.

- There is no appeal from a Final Order.

The fine regimen for violations under INA § 274A, 274C, and 274D are proscribed by statute and the amounts adjusted annually for inflation.